Book viewings, submit offers and valuations online 24/7

Benefits of our conveyancing include:

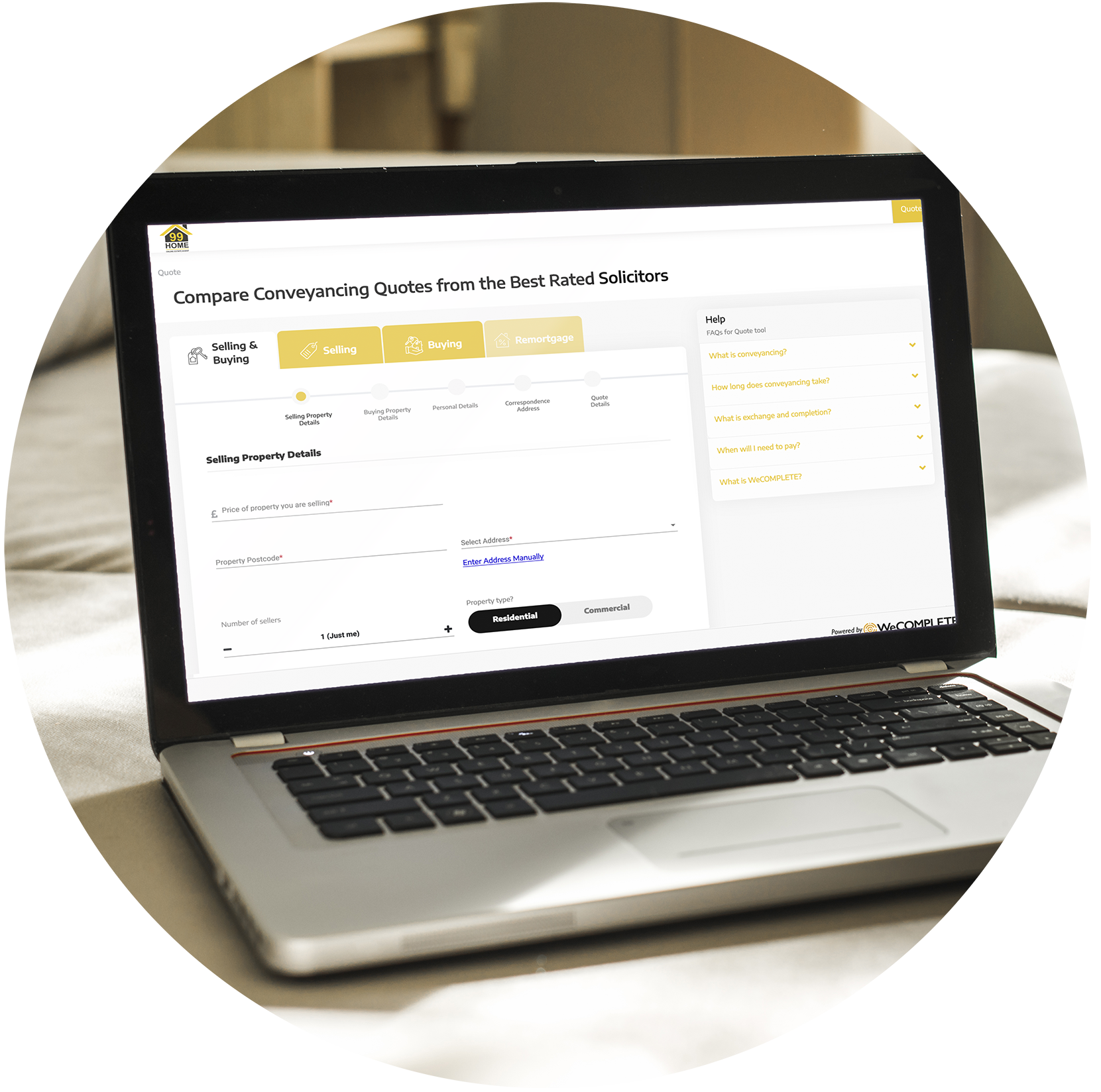

With 99home, you can get the best conveyancing quotes in three simple steps

1. Fill in some basic details of your property sale, purchase or remortgage.

2. Instantly compare quotes from property solicitors to find a legal team that suits your needs best.

3. Select and instruct a legal team dedicated to a hassle- free completion of your property.

I agree Our site saves small pieces of text information (cookies) on your device in order to deliver better content and for statistical purposes. You can disable the usage of cookies by changing the settings of your browser. By browsing our website without changing the browser settings you grant us permission to store that information on your device.